Over the last few years, something quietly remarkable has been happening in Nigerian real estate. While land remains the single biggest store of wealth for many Nigerians — locally and in the diaspora — the tools for buying, validating, and managing land are changing dramatically. Today, thanks to what we call PropTech Nigeria, investors and homebuyers can access land-bots, geospatial data, automated valuation engines, and—finally—digital title registries.

Imagine this: instead of trudging through dusty registry offices for weeks, a Nigerian diaspora investor in London gets verification of a plot in Lekki within hours via a digital portal. Or a startup using AI and public registry data flags a suspicious “double sale.” These are no longer sci-fi dreams — they are unfolding realities.

In this post, you will learn what PropTech Nigeria really means, how land bots and data are already shifting the balance, what’s working (and what isn’t), and how you — as investor, estate agent, founder or policymaker — can stay ahead of the curve.

What “PropTech Nigeria” Means Today

PropTech — short for property technology — refers broadly to any digital or technological solution that improves how real estate is marketed, bought, sold, managed or verified. In Nigeria, PropTech now spans:

- Online listings and marketplaces (for sale, rent, investment)

- Automated valuation and analytics platforms leveraging big data

- Digital land registries and cadastre systems, replacing manual paperwork and bureaucratic delays

- “Land-bots” or chat/automation tools that help with lead generation, title checks or document verification (see below)

- Platforms integrating legal, fintech and real-estate workflows — creating end-to-end digital property transactions.

In essence: PropTech Nigeria is no longer a fringe buzzword. It is becoming the backbone for a more transparent, efficient and investor-friendly real estate industry.

The Rise of Land Bots & Automation

A key frontier of PropTech Nigeria is the use of “land bots” — AI-powered or automated tools that handle repetitive tasks such as lead qualification, document pre-checks, and initial title verification.

- One of the clearest examples is LandSafe — a 2025-launched platform that uses AI plus a network of vetted legal professionals to authenticate property documents, check for encumbrances, and flag potential ownership disputes.

- These bots dramatically speed up what used to take weeks: LandSafe claims it can run title checks and verification much faster than manual vetting.

- The benefits: fewer time delays, lower dependency on opaque agents or middlemen, and an added sense of confidence for buyers (especially diaspora or remote investors).

While land bots are not (yet) capable of replacing full legal due diligence, they provide a critical first line of defence — filtering out obviously problematic deals before you commit.

Data, Geospatial & Valuation: The New Frontier

Digital land registry systems and data-driven valuation tools are turning disparate paper records into actionable, reliable information.

Digital land registry systems and data-driven valuation tools are turning disparate paper records into actionable, reliable information.

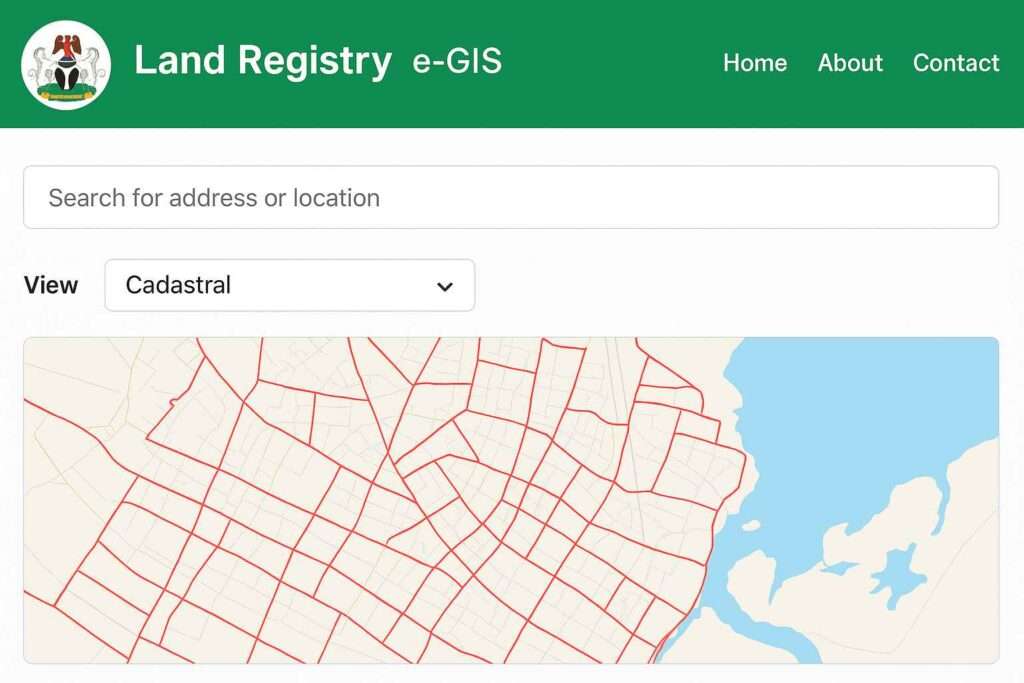

- Systems such as the launch of the e‑GIS portal by the Lagos State Ministry of Lands and Survey mark a shift from manual registry logbooks to searchable, geo-referenced entries.

- The national-level initiative under the National Land Registration, Documentation, and Titling Program (NLRDTP) aims to digitise land registration across Nigeria, thereby boosting transparency and unlocking the economic potential of land as a fungible asset.

- On the valuation side, firms such as Estate Intel are utilising market data, transaction history, and analytics to generate insights for investors — helping them identify zones with high appreciation potential.

- Additionally, big data and AI can help forecast demand trends, ideal investment times, or under-priced plots — enabling smarter, more data-driven investment decisions instead of speculation.

Digital Title Verification & Risk Reduction

Historically, property transactions in Nigeria have been fraught with risks: forged documents, multiple claims, lost deeds, and “ghost allocations.” PropTech is beginning to tackle these pain points head-on:

- The e-GIS portal in Lagos now lets buyers, lawyers, and agents verify official land records (file number, plot number or survey plan) online — reducing the need for middlemen and discouraging forgeries.

- Platforms like LandSafe integrate public registry data (where available) with vetting by legal professionals, offering end-to-end verification services. This effectively digitises a step of due diligence that once required hours or days at the registry.

- The legal foundation remains important: under the law, valid land ownership still requires lodgment at the relevant state land registry, C of O or registered title, plus deed of assignment, survey plan, and (if transferring) Governor’s consent.

Hence, while digital tools reduce risk, legal registration remains non-negotiable. But when used well, PropTech makes verification far more efficient and accessible — especially for diaspora investors or remote buyers.

Use Cases & Winners

| Use Case | Who Benefits / Example / Outcome |

|---|---|

| Pre-purchase title check | A Lagos-based buyer uses LandSafe to verify a plot — avoids buying a parcel with prior encumbrances. |

| Data-driven valuation & investment analytics | An investor uses Estate Intel to identify under-priced land in Abuja showing growth potential, securing a high-yield long-term investment. |

| Full digital transaction management | A real estate broker uses Contract2Close.Com (C2C) — launched June 2025 — to manage contracts, documents, communication and closing online, reducing delays and friction in deals. Businessday NG |

Why these matter: They show that PropTech isn’t just about fancy tech — it’s about solving real, painful bottlenecks (fraud, delays, opacity) and creating real value for buyers, sellers, agents, and even regulators.

What This Means for Investors — Practical Guidance & Due Diligence

If you’re investing in Nigerian real estate (especially as a diaspora investor or large-scale buyer), here’s how to leverage PropTech — and what to watch out for:

Best practices:

- Use a trusted digital title verification tool (e.g. LandSafe) before committing payment.

- Combine digital verification with traditional legal due diligence (survey plan, Deed, Governor’s Consent, registry check).

- Use data-driven platforms (like Estate Intel) to benchmark price trends, appreciation forecasts, and neighbourhood growth potential.

- Document everything — screenshots, reference numbers, contract copies — especially if you transact remotely.

Also Read: Registered Survey vs Provisional Survey in Nigeria: The Ultimate Guide Every Smart Buyer Needs

Red flags / Limitations:

- Not all land records are digitised — many states are still catching up. So a “no record found” result may simply be due to incomplete data, not fraud. Always cross-check manually if possible.

- Data-driven valuations depend heavily on the quality and depth of transaction history. In under-sampled areas, estimates may be unreliable.

- PropTech tools are aids, not replacements, for legal verification. Always insist on registered documents lodged at the official state registry.

Policy, Gaps & What Needs to Be Fixed

For PropTech Nigeria to truly scale, several systemic challenges remain:

- Incomplete digitisation of land records — many states still rely on paper registries; until all states adopt systems like e-GIS or similar, gaps remain. For example, while Lagos is ahead, other states lag.

- Data quality and standardisation — inconsistent survey plan formats, missing metadata, or lack of unique identifiers make nationwide aggregation hard.

- Regulatory clarity around blockchain / smart-contract titling — although some sources discuss blockchain-based land titling, it remains unclear whether Nigerian courts will accept fully digital deeds without a traditional Certificate of Occupancy (C of O) or registry lodgment.

- Digital literacy & adoption — many real estate agents, local governments, or buyers lack familiarity with technology tools; there is resistance to change, and sometimes deliberate obfuscation by intermediaries threatened by transparency.

What policymakers and industry should do: Accelerate nationwide adoption of digital land registries, standardise cadastral data formats, mandate public access to registry data, and run public awareness campaigns to build trust in PropTech tools.

In conclusion, PropTech Nigeria is not hype — it is transforming one of the most important asset classes in the country. From land bots that expedite verification to data-driven valuation engines and digital registries, technology is gradually but steadily reshaping the risks, opportunities, and mechanics of real estate investment in Nigeria.

For investors, estate agents, founders and policy-makers: the message is clear. Embrace PropTech — but do not abandon rigorous due diligence. Use bots and data as powerful tools, but always verify with legal and registry-backed documents.

Because in a market where land is wealth, transparency and verification — powered by tech — are the difference between a wise investment and a costly mistake.

If you are considering buying land or investing in property in Nigeria, start with a digital title-scan, then move to full registry verification.

If You’ll Use a Land Bot or PropTech Tool — Do These Checks First

- Confirm that the tool references the relevant state land registry database (e.g. for Lagos, the e-GIS / LIMS portal).

- Request and verify the survey plan number and file/plan number — not just the seller’s word.

- Cross-check with manual registry records (if possible) — especially for older or rural plots.

- Insist on original documents (Certificate of Occupancy, Deed of Assignment, Governor’s Consent, where applicable).

- Ensure the seller provides a valid chain of title — with dates, registered transfers, and a clear history.

- Check the tool’s track record — how often its verifications uncovered fraud or issues.

- For valuations, confirm underlying dataset coverage — limited data yields unreliable valuations.

- Store snapshots/screenshots of verification outputs, timestamps, and reference IDs.

- If the transaction involves payment, use escrow or bank-facilitated payment channels (avoid cash).

- Engage a licensed surveyor or property lawyer — bots are tools, not replacements.

Also Read: Nigeria Real Estate Investment for Foreigners: 5 Reasons Why It’s a Top Choice

3 Recommended PropTech Use Cases for Investors

- Pre-Purchase Title Scan: Use tools like LandSafe to do an initial digital title check before even visiting the site.

- Automated Valuation & Market Analytics: Use platforms such as Estate Intel to gauge price trends, likely appreciation zones, and avoid overpriced land.

- Post-Purchase Monitoring: Once you own land or property — track registry updates, encumbrances, changes via digital portals or PropTech tools to safeguard against illegal claims.

FAQs

What is PropTech Nigeria?

PropTech Nigeria refers to the adoption of digital, data-driven and tech-enabled tools and platforms that modernise buying, selling, registering, valuing and managing real estate in Nigeria.

Can I verify land titles online in Nigeria today?

Yes — in some states, such as Lagos, you can use portals like the e-GIS digital registry to verify land titles, survey plans, and ownership records — though full coverage is still rolling out.

Will PropTech tools replace lawyers or surveyors in land transactions?

No. PropTech tools can accelerate and simplify preliminary checks, but full legal verification, document lodgement and surveyor inspections remain essential.

Are digital valuations accurate for all locations in Nigeria?

Not always. Accuracy depends on the volume and quality of transaction data for a zone. In under-sampled or rural areas, valuations may be unreliable.

What should I do before buying land using a PropTech platform?

Use a digital title-scan, get original documents (C of O, Deed, survey plan), cross-check registry records, engage a lawyer/surveyor, and pay through secure banking or escrow channels.

Teta Homes helps Individuals in Nigeria and the diaspora to Invest Right In Real Estate. For Questions On This Article Or Enquiring About Real Estate – Email: [email protected]; [email protected]; or Whatsapp/Call +2347061199407